Bao Inc. issued its Class H series bonds at $10 40

Bao Inc. issued its Class H series bonds at $10,400 on 1/1/x3. Class H bonds have a 10% coupon paid semi-annually and a face value of $10,000, maturing in two years. Using the effective interest method, calculate the amount of interest expense associated with the Class H bonds reported by Bao for the period ending 12/31/x3.

A. $405.

B. $808.

C. $1,000.

参考解答

Ans:B.

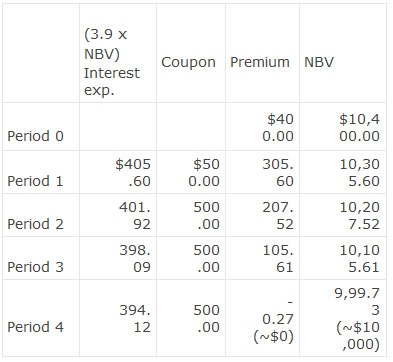

The periodic payment is $500 or one-half of the 10% annual coupon. The yield-to-maturity is solved for, using a financial calculator, as 3.90% semi-annually (see below). At the end of the first reporting period (Year 1), the total interest expense is $807.52 (=$405.60 + 401.92).

Periodic coupon payment

= semi-annual payment x coupon rate x face value

=0.5 x 10.0% x $10,000

= $500

Semi-annual yield-to-maturity:

N=4; PV= -$10,400; PMT =$500; FV = $10,000

Compute 1/Y = 3.90 semi-annual effective interest rate Interest expense

Interest expense

= NBV of bond at end of previous period x effect interest rate

NBV t= NBV t-1 + interest expense – coupon

Interest expense = 405.60 + 401.92 = 807.52

相似问题

In general as compared to companies with operatin

In general, as compared to companies with operating leases, companies with finance leases report:A lower working capital and a

A retail company that leases the majority of its s

A retail company that leases the majority of its space has total assets of $4,500 million and total long-term debt of $2,1

Bond Features Inc.(“BFI”) has bonds outstanding w

Bond Features, Inc (“BFI”) has bonds outstanding with a $900,00 par value The BFI bonds pay a 4 5% coupon, mature in three

Matrix pricing is a process in which a bond’s yiel

Matrix pricing is a process in which a bond’s yield-to-maturity is determined from bonds currently available in the market

A company had the following events related to $5 m

A company had the following events related to $5 million of 10-year bonds with a coupon rate of 8% payable semi-annually o