A retail company that leases the majority of its s

A retail company that leases the majority of its space has total assets of $4,500 million and total long-term debt of $2,125 million bearing an average interest rate of 10%.

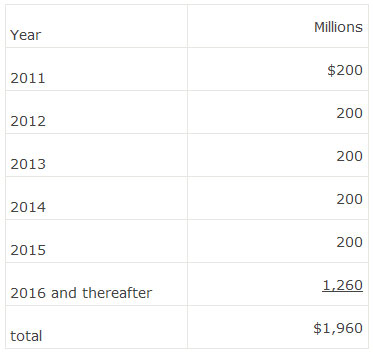

Note 8: Operating leases

After adjustment for the off-balance-sheet financing, the debt-to-total-assets ratio for the company is closest to:

A. 58%.

B. 62%.

C. 72%.

参考解答

Ans:A.

The present value of the operating leases should be added to both the total debt and the total assets. To estimate the present value it is appropriate to estimate the number of years of lease payments reflected in the 2016 and thereagter figure. Based on the constant expense shown in the first 5 years, there are 9 (1,260/140) more payment for total of 14 payments.

Adjusted debt to total assets

= (2,125+1,134)/(4,500+1,134)=57.8%

相似问题

Bond Features Inc.(“BFI”) has bonds outstanding w

Bond Features, Inc (“BFI”) has bonds outstanding with a $900,00 par value The BFI bonds pay a 4 5% coupon, mature in three

Matrix pricing is a process in which a bond’s yiel

Matrix pricing is a process in which a bond’s yield-to-maturity is determined from bonds currently available in the market

A company had the following events related to $5 m

A company had the following events related to $5 million of 10-year bonds with a coupon rate of 8% payable semi-annually o

At the beginning of the year a company issued a $

At the beginning of the year, a company issued a $1,000 face value bond Interest on that bond is paid semiannually, the an

A dealer of large earth movers that leases the mac

A dealer of large earth movers that leases the machinery to its customers is most likely to treat the leases as:A operating