On 1 January 2008 a company enters into a lease ag

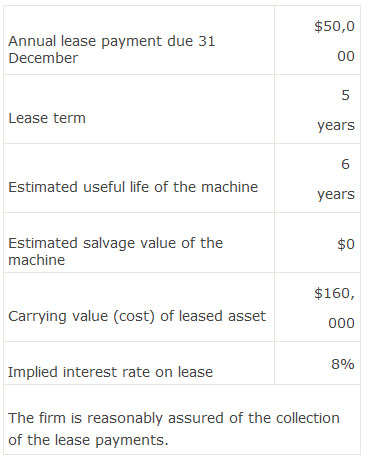

On 1 January 2008 a company enters into a lease agreement to lease a piece of machinery as the lessor with the following terms:

Which of the following best describes the classification of the lease on the company’s financial statements for 2008?

A.Operating lease.

B.Sales type lease.

C.Direct financing lease.

参考解答

Ans:B.

Under U.S.GAAP, lessee must treat a lease as a capital (finance) lease if any of the following criteria are met:

Title to the leased asset is transferred to the lessee at the end of the lease period.

A bargain purchase option permits the lessee to purchase the leased asset for a price that is significantly lower than the fair market value of the asset at some future date.

The lease period is 75% or more of the asset’s economic life.

The present value of the lease payments is 90% or more of the fair value of the leased asset.

Under U.S.GAAP, if any one of the capital (finance) lease criteria for lessees is met, and the collectability of lease payments is reasonably certain, and the lessor has substantially completed performance, the lessor must treat the lease as a capital (finance) lease.

From the lessor’s perspective, a capital lease under U.S.GAAP is treated as tither a sales-type lease or a direct financing lease.If the present value of the lease payments exceeds the carrying value of the assets, the lease is treated as a sales-type lease.If the present value of the lease payments is equal to the carrying value, the lease is treated as a direct financing lease.

It is a sales type lease: the lease period covers more than 75% of its useful life (5/6=83.3%) and the asset is on its books at less than the present value of the lease payments ($199,635) (PMT = $50,000, N=5, i=8%).The firm must have acquired or manufactured the asset if it is recorded at less than the present value of the lease payments.

相似问题

From the lessee’s perspective compared to an oper

From the lessee’s perspective, compared to an operating lease, a finance lease results in:A higher asset turnover B a higher debt-to-equity ratio C lower operating cash flow

Compared to an operating lease a capital lease wi

Compared to an operating lease, a capital lease will have what effects on operating income (earnings before interest and tax

Debt covenants to protect bondholders areleast lik

Debt covenants to protect bondholders areleast likely to:A restrict the issuance of new debt B require sinking fund redemptions C prohibit bond repurchases at a premium to par

On 1 January 2012 a company enters into a lease ag

On 1 January 2012 a company enters into a lease agreement to lease a piece of machinery as the lessor with the following

Which of the following statement most accurately r

Which of the following statement most accurately reflects the effective interest method of amortizing bond premium and discoun