Madison Inc. is planning a bond issue. They are co

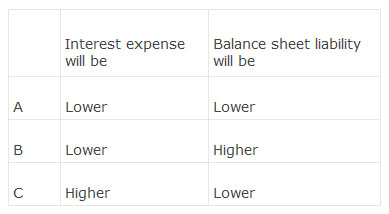

Madison Inc. is planning a bond issue. They are considering issuing either a straight coupon bond or a coupon bond with warrants attached. The proceeds from either issue would be the same. What will be the effect on their interest expense and balance sheet liability if they issue the bonds with warrants as compared to the straight bonds? For the bonds with warrants the:

参考解答

Ans:A.

The portion of the proceeds attributable to the warrants would be classified as equity, thus the portion classified as a liability would be smaller (lower). The lower balance sheet value would lead to a lower interest expense when it is calculated. The interest expense is based on the liability at the beginning of the period, not the coupon payment.

相似问题

On 1 January 2008 a company enters into a lease ag

On 1 January 2008 a company enters into a lease agreement to lease a piece of machinery as the lessor with the following

From the lessee’s perspective compared to an oper

From the lessee’s perspective, compared to an operating lease, a finance lease results in:A higher asset turnover B a higher debt-to-equity ratio C lower operating cash flow

Compared to an operating lease a capital lease wi

Compared to an operating lease, a capital lease will have what effects on operating income (earnings before interest and tax

Debt covenants to protect bondholders areleast lik

Debt covenants to protect bondholders areleast likely to:A restrict the issuance of new debt B require sinking fund redemptions C prohibit bond repurchases at a premium to par

On 1 January 2012 a company enters into a lease ag

On 1 January 2012 a company enters into a lease agreement to lease a piece of machinery as the lessor with the following