The effects on a firm’s financial statement in the

The effects on a firm’s financial statement in the initial year when cost of an asset is expensed rather than capitalized are:

A.Pre-tax cash flow is lower and the debt-to-equity ratio is higher.

B.Pre-tax cash flow remains the same and the debt-to-equity ratio is lower.

C.Pre-tax cash flow remains the same and the debt-to-equity ratio is higher.

参考解答

Ans:C

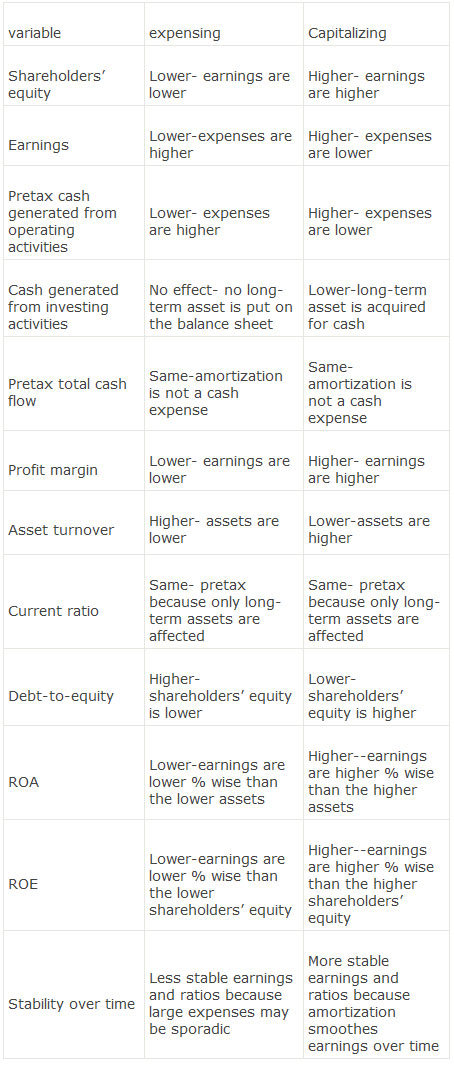

Pre-tax cash flow stays the same because depreciation (or amortization) is a non-cash expense.

However, when the cost is expensed rather then capitalized, net income and retained earnings are lower, resulting in a lower equity.So the debt-to-equity ratio will be higher.

Effects of expensing versus capitalizing costs in the year of the capitalization:

相似问题

Which of the following is the least likely reason

Which of the following is the least likely reason as to why a firm’s management would increase the value of a capital as

Hadinoto Enterprises Inc.(HEI) purchased equipment

Hadinoto Enterprises Inc (HEI) purchased equipment for $400,00 on January 1, 20x5 The equipment has a 4 year life and no sal

A Mexican corporation is computing the depreciatio

A Mexican corporation is computing the depreciation expense of a piece of manufacturing equipment for the fiscal year ended

下列属于要素市场的有( )。A.金融市场B.信息市场C.劳动力市场D.消费品市场E.生产资料市场

下列属于要素市场的有( )。A 金融市场B 信息市场C 劳动力市场D 消费品市场E 生产资料市场

( )是指资金的筹集.投放.使用.收回及分配等一系列企业资金收支活动的总称 它贯穿于企业经营过程的始

( )是指资金的筹集 投放 使用 收回及分配等一系列企业资金收支活动的总称,它贯穿于企业经营过程的始终。A 筹资活动B 投资活动C 财务活动D 财务管理