A Mexican corporation is computing the depreciatio

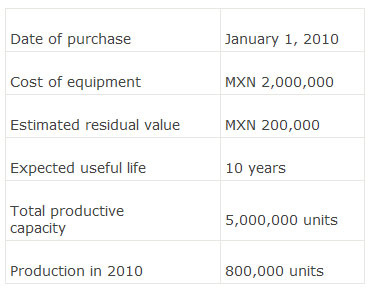

A Mexican corporation is computing the depreciation expense of a piece of manufacturing equipment for the fiscal year ended December 31, 2010 using the information below.The company takes a full year’s depreciation in the year of acquisition.

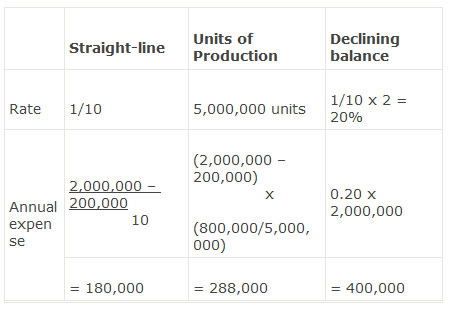

The depreciation expense (in MXN) will most likely be:

A.180,000 lower using the straight-line method compared with the double-declining balance method.

B.140,000 higher using the units-of-production method compared with the straight-line method.

C.112,000 higher using the double-declining method compared with the units-of-production method.

参考解答

Ans:C.

The difference between the double declining balance and units-of-production is:

400,000 – 288,000 = 112,000.

Difference between the declining balance and units of production is:

= 400,000 – 288,000 = 112,000

相似问题

下列属于要素市场的有( )。A.金融市场B.信息市场C.劳动力市场D.消费品市场E.生产资料市场

下列属于要素市场的有( )。A 金融市场B 信息市场C 劳动力市场D 消费品市场E 生产资料市场

( )是指资金的筹集.投放.使用.收回及分配等一系列企业资金收支活动的总称 它贯穿于企业经营过程的始

( )是指资金的筹集 投放 使用 收回及分配等一系列企业资金收支活动的总称,它贯穿于企业经营过程的始终。A 筹资活动B 投资活动C 财务活动D 财务管理

社会主义社会存在商品经济的主要原因是( )。A.社会分工B.社会化大生产C.生产资料公有制D.按劳分

社会主义社会存在商品经济的主要原因是( )。A 社会分工B 社会化大生产C 生产资料公有制D 按劳分配E 独立经济利益实体的存在

A company purchases a piece of equipment costing $

A company purchases a piece of equipment costing $7,000,000 that it expects will have a useful life of 5 years and a salv

On January 1 Year 1 a firm purchases a machine f

On January 1, Year 1, a firm purchases a machine for $68,000 that has an estimated useful life of five years, at which t