Company Y has provided the following information f

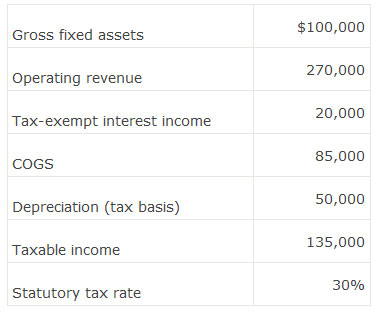

Company Y has provided the following information from its current year financial statements and tax return. Company Y’s fixed assets have a four-year useful life for financial purpose (which is double the useful life for tax purpose) and are depreciated using the straight-line method.

The effective tax rate for the company is closest to:

A.30.0%

B.26.7%

C.24.0%.

参考解答

Ans: B.

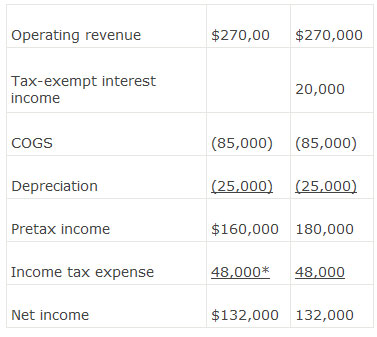

To calculate the effective tax rate, income tax expense must be calculated without the tax-exempt interest income (and using half of the tax basis depreciation). Then pretax income must be calculated including the tax exempt interest and adjusted depreciation for financial purposes. The effective tax rate is the income tax expense calculated without the tax-exempt interest divided by the pre-tax income including the tax exempt interest income.

*Income tax expense = 30% x 160,000 = 48,000

Effective tax rate = 48,000/ 180,000 = 26.67%

相似问题

A company incurred and capitalized €2 million of d

A company incurred and capitalized €2 million of development costs during the year These costs were fully deductible immediat

On January 2 a company acquires some state-of-the

On January 2, a company acquires some state-of-the-art production equipment at a net cost of $14 million For financial repo

When the expected tax rate changes deferred tax:A

When the expected tax rate changes, deferred tax:A expense is calculated using current tax rates with no adjustments B liabilit

对金融衍生产品而言 信用风险造成的损失最多是其债务的全部账面价值。( )A.正确B.错误

对金融衍生产品而言,信用风险造成的损失最多是其债务的全部账面价值。( )A 正确B 错误

中国银监会规定操作风险应当包括法律风险和声誉风险。( )A.正确B.错误

中国银监会规定操作风险应当包括法律风险和声誉风险。( )A 正确B 错误