On January 2 a company acquires some state-of-the

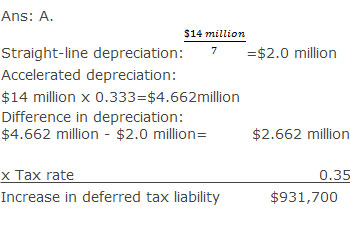

On January 2, a company acquires some state-of-the-art production equipment at a net cost of $14 million. For financial reporting purposes, the firm will depreciate the equipment over a 7-year life using straight-line depreciation and a zero salvage value; for tax reporting purposes, however, the firm will use 3-year accelerated depreciation. Given a tax rate of 35% and a first-year accelerated depreciation factor of 0.333, by how much will the company’s deferred tax liability increase in the first year of the equipment’s life?

A.$931,700.

B.$1,064,800.

C.$1,730,300.

参考解答

相似问题

When the expected tax rate changes deferred tax:A

When the expected tax rate changes, deferred tax:A expense is calculated using current tax rates with no adjustments B liabilit

对金融衍生产品而言 信用风险造成的损失最多是其债务的全部账面价值。( )A.正确B.错误

对金融衍生产品而言,信用风险造成的损失最多是其债务的全部账面价值。( )A 正确B 错误

中国银监会规定操作风险应当包括法律风险和声誉风险。( )A.正确B.错误

中国银监会规定操作风险应当包括法律风险和声誉风险。( )A 正确B 错误

银行全面风险管理的要素包括内部环境 目标设定 事项识别 风险评估和风险应对五个方面。(判断题)银行全

银行全面风险管理的要素包括内部环境、目标设定、事项识别、风险评估和风险应对五个方面。(判断题)银行全面风险管理的要素包括内部环境、目标设定、事项

内幕交易属于操作风险中的内部欺诈事件。( )A.正确B.错误

内幕交易属于操作风险中的内部欺诈事件。( )A 正确B 错误