When the Bao Company filed its corporate tax retur

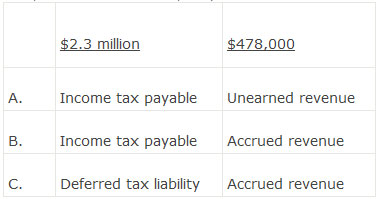

When the Bao Company filed its corporate tax returns for the first quarter of the current year, it owed a total of $6.7 million in corporate taxes. Bao paid $4.4 million of the tax bill, but still owes $2.3 million. It also received $478,000 in the second quarter as a down payment towards $942,000 in custom-built products to be delivered in the third quarter. Its financial accounts for the second for the second quarter most likely show the $2.3 million and the $478,000 as:

参考解答

Ans: A.

The $478,000 is unearned revenue, a liability. The $2.3 million owned to the government but not yet paid is income tax payable, also a liability. Deferred tax accounts arise from temporary differences between tax reporting and financial reporting.

相似问题

Which of the following definitions used in account

Which of the following definitions used in accounting for income taxes is least accurate?A Income tax expense is based on cu

Under U.S.GAAP which of the following factors is

Under U S GAAP, which of the following factors is an analyst least likely to consider when determining if a company’s defer

Which of the following statements most accurately

Which of the following statements most accurately describes a valuation allowance for deferred taxes? A valuation allowance is

At the beginning of the year a company purchased a

At the beginning of the year a company purchased a fixed asset for $500,000 with no expected residual value The company dep

A financial analyst would classify deferred tax li

A financial analyst would classify deferred tax liabilities as equity (versus a liability) when:A the deferred tax liabilities