At the beginning of the year a lessee company ent

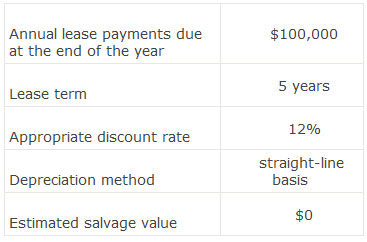

At the beginning of the year, a lessee company enters into a new lease agreement that is correctly classified as a finance lease, with the following terms:

With respect to the effect of the lease on the company’s financial statements in the first year of the lease, which of the following is most accurate? The reduction in the company’s:

A.pretax income is $72,096.

B.cash flow from financing is $56,742.

C.cash flow from operations is $72,096.

参考解答

Ans:B.

The present value of the lease is $360,477.62.(n = 5, I = 12%, PMT = $100,000) 12% of the original PV is $43,257.31 and represents the interest component of the payment in the first year.The difference between the annual payment and the interest is the amortization of the lease obligation included in cash flow from financing.$100,000 – 43,257.31 = $56,742.69.

A is incorrect.Depreciation is $360,477.62 / 5 or $72,095.52 so the total reduction in pretax income would be interest plus depreciation or $115,352.83 (=43,257.31+72,095.52).

C is incorrect.Cash flow from operations would be reduced by the amount of the interest only (43,257.31) because the depreciation would be added back to determine cash flow from operations.

相似问题

Which of the following statements about the treatm

Which of the following statements about the treatment of leases on the lessor’s financial statements is least accurate?A If

Which of the following is correct regarding the im

Which of the following is correct regarding the impact of convertible bonds on a company’s financial statements and ratios:A

Nan Chen works for a firm that offers a benefit pl

Nan Chen works for a firm that offers a benefit plan that guarantees her an annual payment in retirement equal to her ave

The following information is available from a comp

The following information is available from a company’s 2012 financial statements:Note 6: employee costs Note 17: retirement b

Bao Company has a defined benefit plan for its emp

Bao Company has a defined benefit plan for its employees Which of the following changes in assumptions would most likely dec