A company has recently revalued one of its depreci

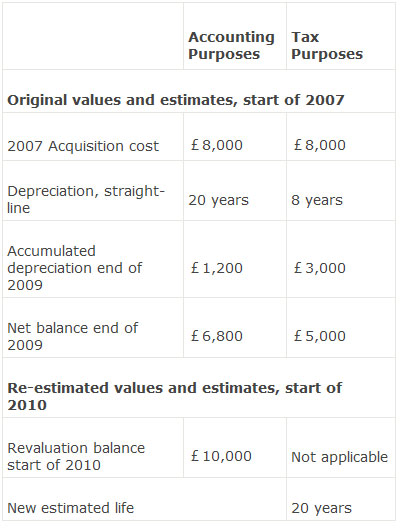

A company has recently revalued one of its depreciable properties and estimated that its remaining useful life would be another 20 years. The applicable tax rate for all years is 30% and the revaluation of the property is not recognized for tax purposes. Details related to this asset are provided in the table below, with all £-values in millions.

The deferred tax liability (in millions) as at the end of 2010 is closest to:

A. £690.

B. £960.

C. £1,650.

参考解答

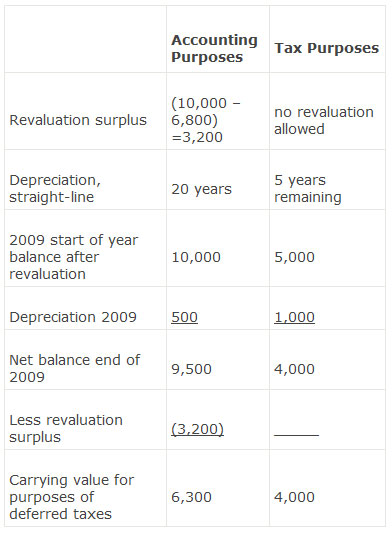

Ans:A. Deferred tax liability = 0.30 x (6,300 – 4,000) =690

Deferred tax liability = 0.30 x (6,300 – 4,000) =690

Only the portion of the difference between the tax base and the carrying amount that is not the result of the revaluation is recognized as giving rise to a deferred tax liability. The portion arising from the revaluation surplus is used to reduce the revaluation surplus in equity.

相似问题

下列哪些单位可以作为保证人?( )A 学校B 医院C 国家机关D 有限公司子公司

下列哪些单位可以作为保证人?( )A、学校B、医院C、国家机关D、有限公司子公司

根据《商业银行法》规定 商业银行对同一借款人的贷款余额与商业银行资本余额的比例不得超过( )A 5%

根据《商业银行法》规定,商业银行对同一借款人的贷款余额与商业银行资本余额的比例不得超过( )A、5%B、8%C、10%D、15%

The following information is available about a com

The following information is available about a company:The company’s 2012 income tax expense (in thousands) is closest to:A $1,000 B $1,050 C $1,250

按照《关于划分企业登记注册类型的规定》 全部企业划分为( )。A. 3个大类 6个中类B. 3个大类

按照《关于划分企业登记注册类型的规定》,全部企业划分为( )。A 3个大类,6个中类B 3个大类,16个中类C 6个大类,6个中类D 6个大类,16个中类

A firm reported higher deferred tax liabilities th

A firm reported higher deferred tax liabilities than deferred tax assets Using the liability method of accounting for deferr