On 1 April 2009 Pandar purchased 80% of the equity

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

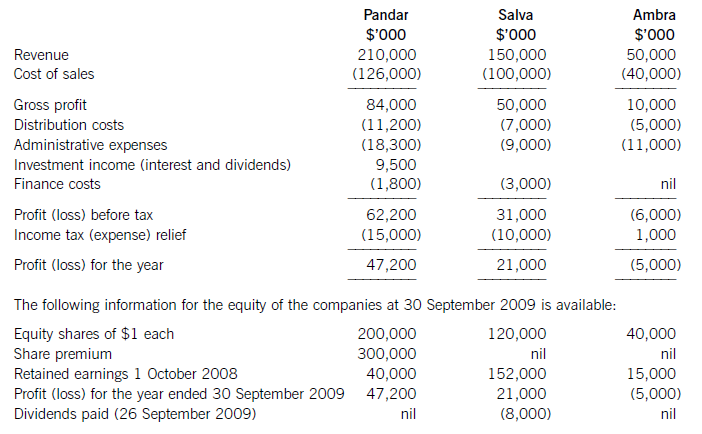

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

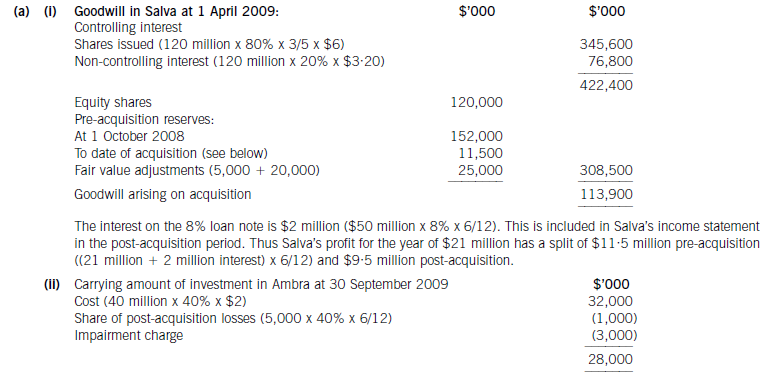

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

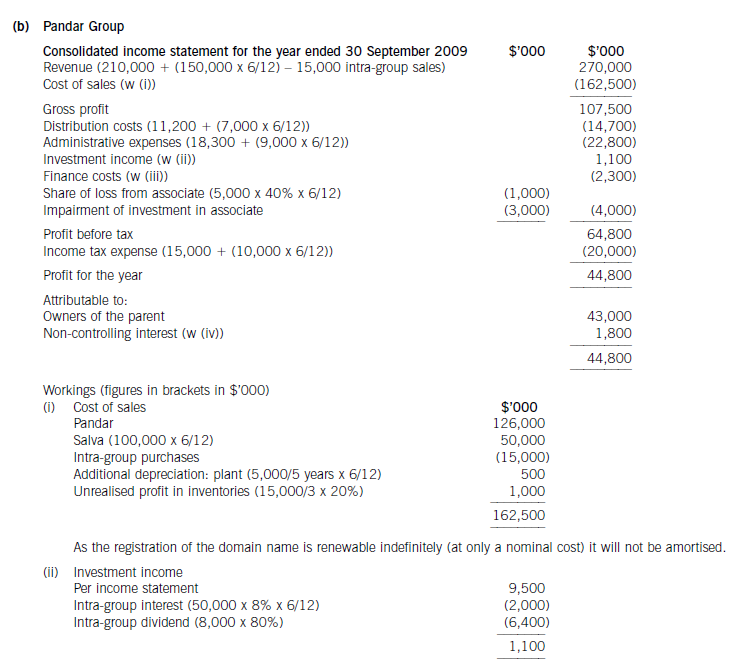

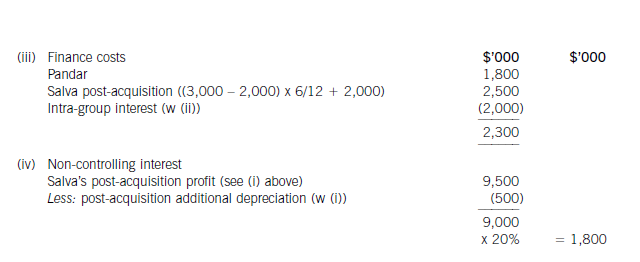

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

请帮忙给出正确答案和分析,谢谢!

参考解答

正确答案:

相似问题

(a) The following information relates to Crosswire

(a) The following information relates to Crosswire a publicly listed company Summarised statements of financial position as at:

(a) An assistant of yours has been criticised over

(a) An assistant of yours has been criticised over a piece of assessed work that he produced for his study course for giv

2013年12月31日 甲公司以银行存款3000万元取得乙公司60%的股权 能够对乙公司实施控制 形

2013年12月31日,甲公司以银行存款3000万元取得乙公司60%的股权,能够对乙公司实施控制,形成非同一控制下的企业合并。购买日,乙公司可辨认净资产的公允

关于合并财务报表中每股收益的计算 下列说法中正确的有( )。A.应当以个别报表中每股收益自述平均数计

关于合并财务报表中每股收益的计算,下列说法中正确的有( )。A 应当以个别报表中每股收益自述平均数计算B 应当按母公司个别报表中每股收益确定C 应当

某企业于2013年11月接受一项产品安装任务 采用完工百分比法确认劳务收入 预计安装期14个月 合同

某企业于2013年11月接受一项产品安装任务,采用完工百分比法确认劳务收入,预计安装期14个月,合同总收入200万元,合同预计总成本为158万元。至2014年底