A company issues $10 million in 8% annual-pay 5-y

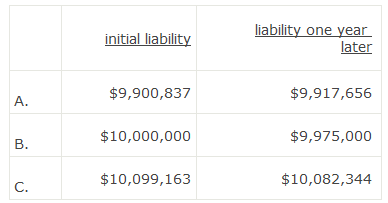

A company issues $10 million in 8% annual-pay, 5-year bonds, when the market rate is 8.25%.the initial balance sheet liability and liability one year from the date of issue are closest to:

参考解答

Ans:A.

PMT = 800,000; FV = 10,000,000; N = 5; I/Y = 8.25;

CPT → PV = $9,900,837

Interest expense = 9,900,836.51 x 0.0825 = $816,819.01

Year-end adjustment = 816,819.01 – 800,000 = $16,819.01

Year-end debt = $9,900,836.51 + $16,819.01 = $9,917,655.52

Note: sine this is a discount bond, we know the initial liability will be less than the face value, so we really didn’t have to do any calculations to answer this question.

相似问题

Bao Capital issed a 5-year $50 million face 6% s

Bao Capital issed a 5-year, $50 million face, 6% semiannual bond when market interest rates were 7% The market yield of the

Which of the following statements regarding the fi

Which of the following statements regarding the financial statement reporting of leases is most accurate?A Under an operating

If the balance sheets of a firm reporting under U.

If the balance sheets of a firm reporting under U S GAAP and a firm reporting under IFRS show equal pension liabilities, it

Compared to an operating lease all other things b

Compared to an operating lease, all other things being equal, over the term of a finance lease,A The interest coverage rat

A firm that reports its lease of a conveyer system

A firm that reports its lease of a conveyer system as an operating lease must disclose:A only the annual lease payment B